Self-Managed Portfolio

You Lead. AI Powers Your Decisions

Make better decisions with 5,000+ stock insights powered by expert AI agents. Get the vision and edge of a full Wall Street team in your pocket.

Get StartedTotally Free

Over 20k users using sagehood daily

A Full Team of AI Analysts, Working for You

Sagehood brings together expert AI agents that analyze market moves like a professional hedge fund team, so you never miss an opportunity.

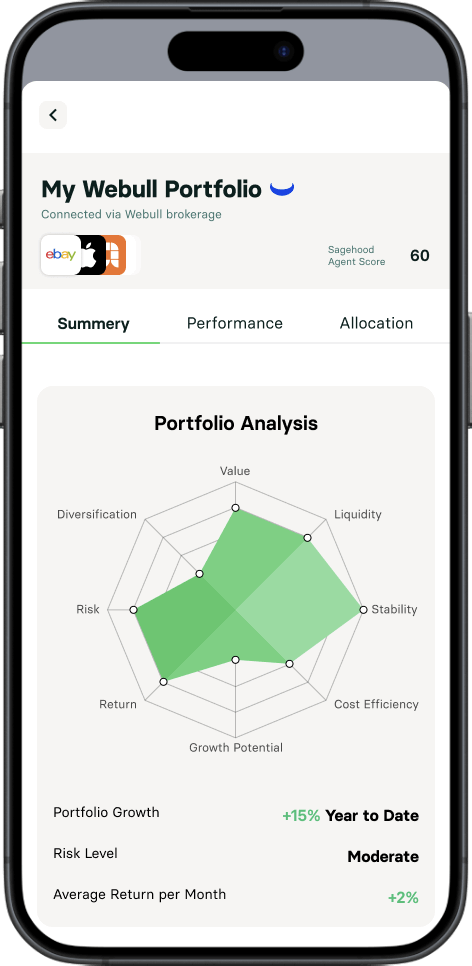

Rebalance & Protect Your Portfolio with AI Agents

Connect your accounts from top brokers in seconds and unlock instant portfolio insights.

Connect Your Portfolio SecurelyConnect Your PortfolioStock Picking at Scale with AI

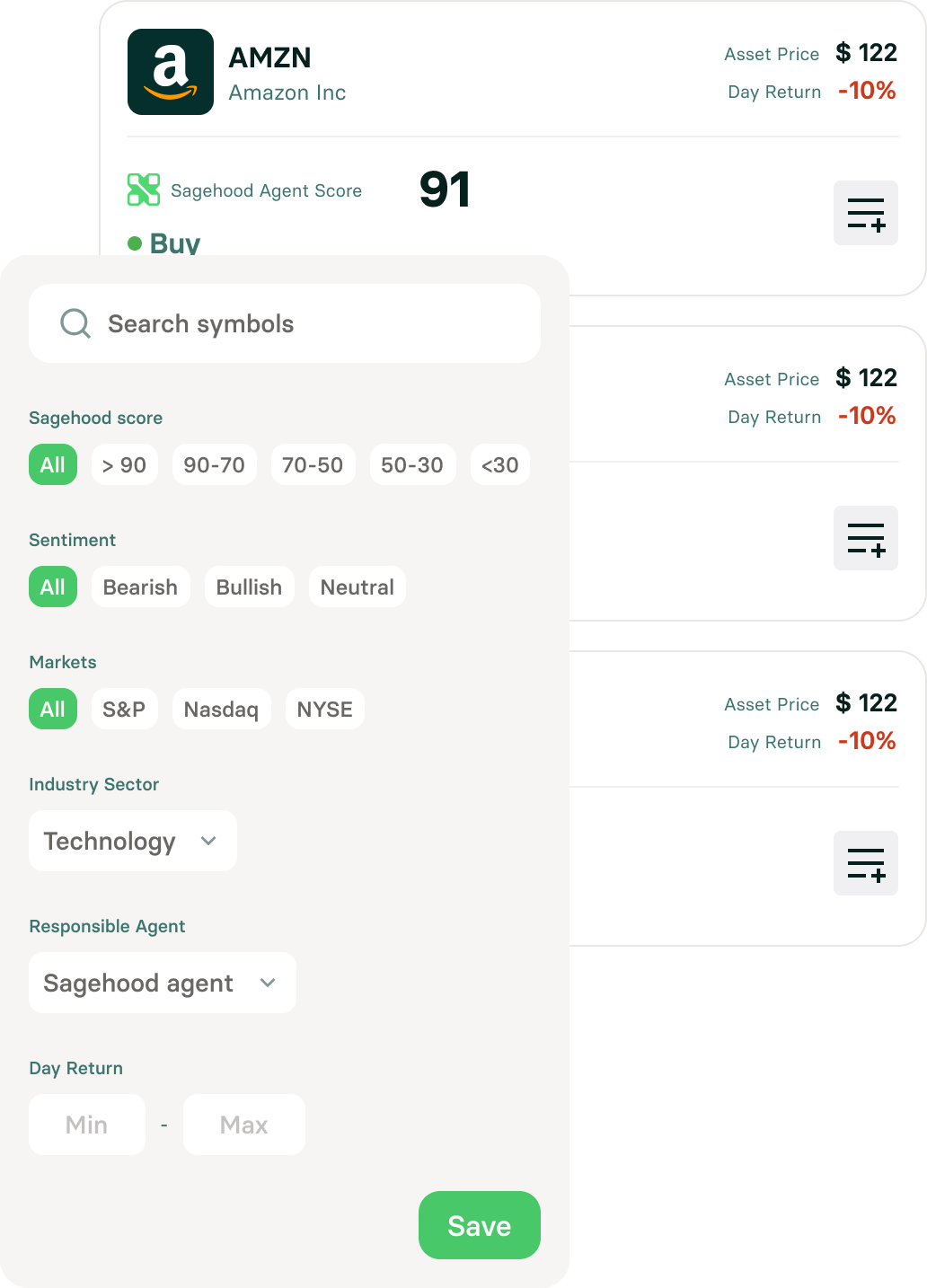

Use AI to analyze thousands of tickers every day, apply smart filters, and find winning stocks easier at scale.

Visit discover page

FAQ

Get the answers you need to make the most out of Sagehood.